Winning by not losing 深溝高磊 不敗而勝

The core of our investment philosophy is to avoid major losses. Asset diversification, multi-strategy implementation, and active risk control all serve a single objective: minimizing the impact of both systematic and idiosyncratic risks.

Benefit of Diversification 分散投資的好處

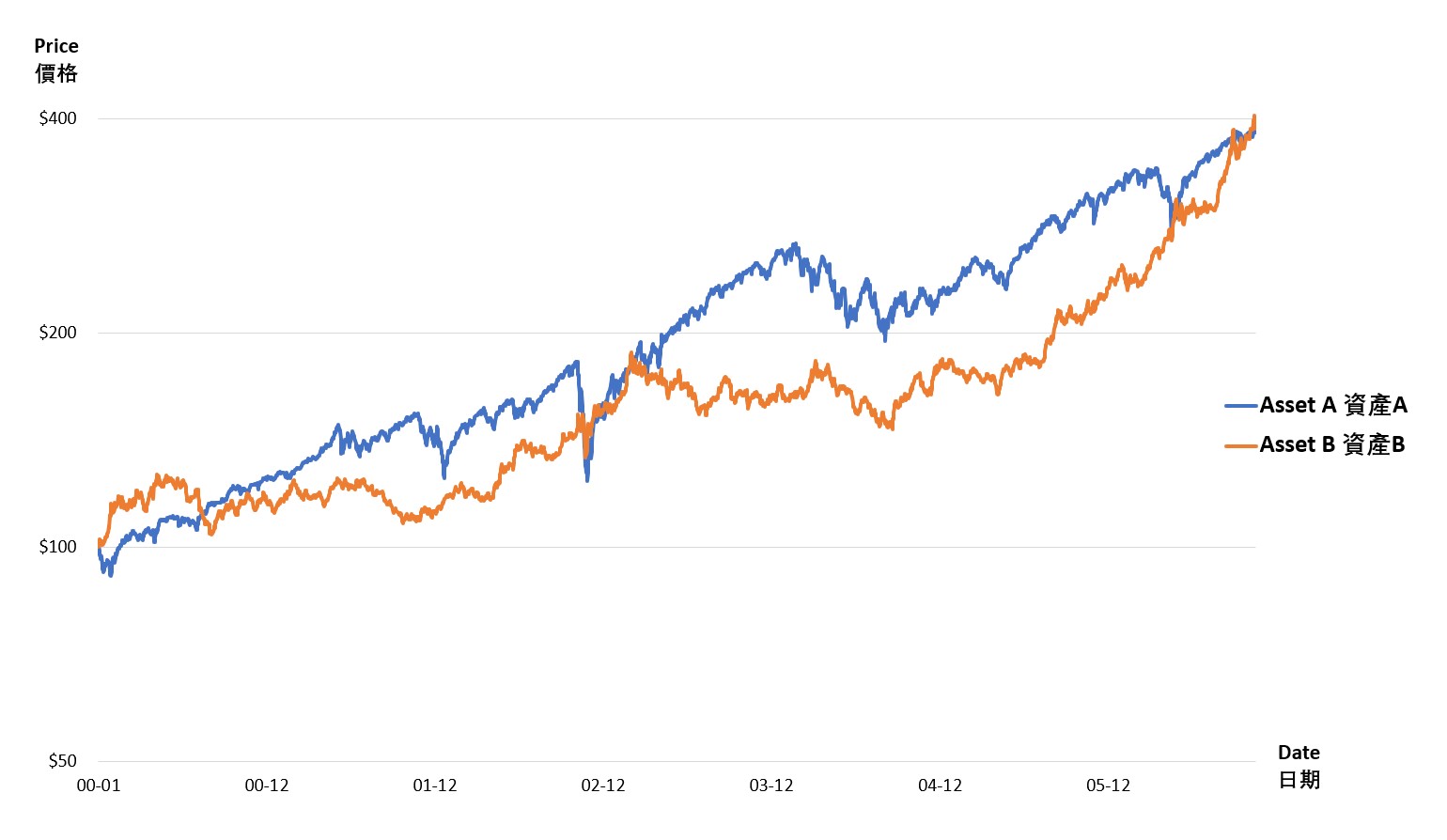

Well-constructed diversification can enhance returns while reducing drawdowns. We demonstrate this concept through the example below. (This example is for illustrative purposes only and does not constitute investment advice. Investors should consult a qualified investment professional before making any investment decisions.) The illustration presents the price movements of two hypothetical, low-correlated assets—Asset A and Asset B. Over the same time period, both assets reach a similar ending price; however, each experiences significant drawdowns at different points along the way.

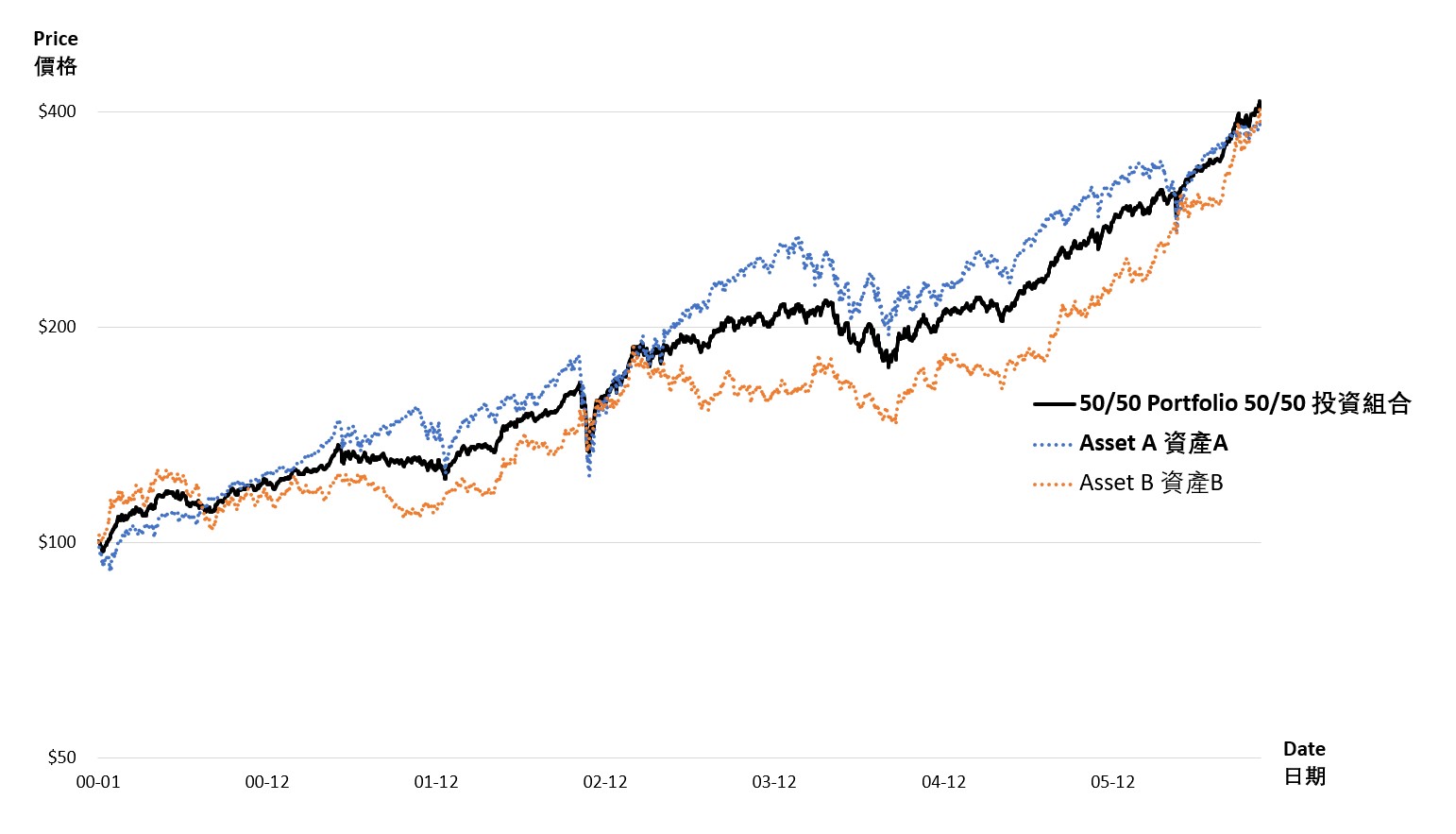

If a portfolio is constructed with a 50% allocation to Asset A and 50% to Asset B and rebalanced on a monthly basis, the resulting portfolio exhibits significantly lower volatility than either asset individually. Despite achieving a similar level of return, the diversified portfolio experiences substantially smaller drawdowns over the same period. A well-constructed portfolio leverages multiple assets, diversified strategies, and disciplined rebalancing to maximize the benefits of diversification.

若将资产 A 与资产 B 各配置 50%,并进行按月再平衡,组合整体的波动性将显著低于任一单一资产。在回报水平相近的情况下,该组合在同一时期内的回撤明显更小。合理构建的投资组合会同时运用多种资产、投资策略以及系统化的再平衡机制,以最大化资产分散化带来的优势。

Asset Diversification 多種資產

Equity 股票

Selected exposure to the S&P 500 for long-term growth.

選取標普 500 指數中的優質證券,主要用於實現長期資本增長。

Fixed Income 債券

Bond strategies to stabilize portfolio risk.

通過多元化債券配置,提升投資組合穩定性並降低波動。

Precious Metal 金銀

Diversification during volatile market conditions.

在市場波動時期提供分散化與潛在增長。

Commodity 大宗商品

Inflation-resilient assets for diversified growth.

在高通脹環境下提供穩定表現與分散化優勢。

Multi Strategies 多策略配合

Our multi-strategy framework is designed to mitigate strategy-specific risk. Buy-and-hold, macro, market-neutral, and other strategies are combined so that different return drivers support the portfolio across varying market environments.

我們同時采用多種投資策略,以降低單一策略失誤時帶來的沖擊。以長期持有、宏觀交易和市場中性等策略相互配合,在某一策略階段性落後時,其他策略的盈利可以幫助穩定整體投資組合的表現。

Select high-quality investment vehicles and hold them over the long term. A well-known proponent of this approach is Warren Buffett.

選擇優質投資標的並長期持有,該策略的代表人物是沃倫·巴菲特。

If you aren't thinking about owning a stock for ten years, don't even think about owning it for ten minutes.

Warren Buffett 沃倫·巴菲特 “股神”

Actively rotate between asset classes based on prevailing macroeconomic conditions. A notable practitioner of this strategy is George Soros.

根據宏觀經濟環境在不同資產之間靈活切換,代表人物為喬治·索羅斯。

My peculiarity is that I don't have a particular style of investing or, more exactly, I try to change my style to fit the conditions.

Hold multiple assets with low correlation simultaneously to achieve a more stable and resilient portfolio. A leading advocate of this approach is Ray Dalio.

同時持有低相關性的多種資產,以提升投資組合的穩定性,代表人物為雷·達里奧。

I created a portfolio mix that I could comfortably put my trust money in for the next hundred or more years. I called it the “All Weather Portfolio” because it could perform well in all environments.

Ray Dalio 瑞·達利歐 “原則一書作者”

Active Risk Control 主動風險管理

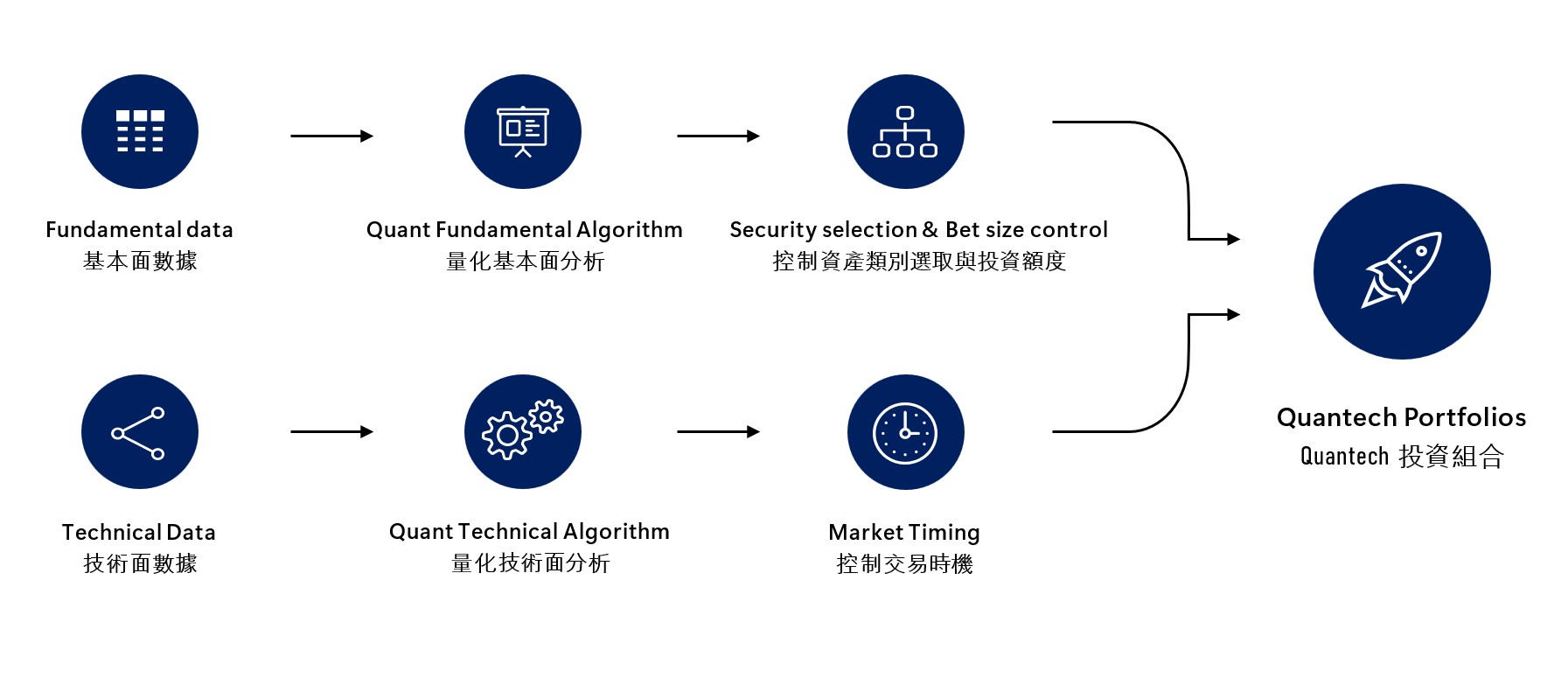

Each holding is regularly evaluated through a disciplined quantitative framework to ensure continued relevance under evolving market conditions. Asset positions are actively rebalanced to reflect changes in the market environment.

我們通過量化流程定期評估每一項持倉在當前市場環境下的適用性,並根據市場變化主動調整各類資產的配置。